Clients & Partners

Reserve Shares

Join the waitlist by reserving shares.

Smart Glasses Are Growing 200% Each Year, But Nobody’s Capturing Facial Data

Wearables are already a massive $84B market2, and smart glasses are the fastest-growing category, expanding 200% each year. But this is just the beginning. The extended reality market - including all technologies that blend the digital and physical worlds like virtual reality (VR), augmented reality (AR), and mixed reality (MR) - is projected to reach $3 trillion3.

Big Tech is already pouring billions into this market, and only Emteq holds the patents for the sensing tech that smart glasses need to deliver real value. As the giants race to dominate the platform, we control a key piece they don’t have.

Meta is scaling production of smart glasses to 10 million units per year

Experts project the XR market will reach $3 trillion in the coming years

Apple and Google are building XR products, including smart glasses

Facial Expression Sensors Track 66.2M Data Points Per Day

Emteq's patented optical flow sensors fit into any smart eyewear and measure subtle facial muscle movements with extreme precision. By tracking 66.2 million data points a day, it unlocks new insight into diet, emotion, and daily activities.

Past attempts at face tracking used small cameras which use vastly more processing, require a custom image chip, consume more power and need a larger battery. Our lensless solution can fit into glasses frames.

Diet

Helping people learn how and why they eat (and change it)

In the $274B global weight loss market, current wearable devices can’t automatically track the most important dietary information: what and how we eat. We deliver proven, behavior-changing assistance by detecting real-time inputs like bite frequency, eating pace, and user emotional states like stress, boredom, and distraction.

Personalized psychological support and insights

One in four people will experience a mental health disorder in their lives, yet half never get diagnosed. The reason? Self-reporting is inherently flawed, especially for conditions people may not know about. Our second product will use our facial sensors to bring emotional health tracking into the real world. By continuously and passively reading subtle expressions and tension, we will provide real-time insight into mood, emotional regulation, and stress, as well as earlier detection and support for issues.

The only wearable capturing emotional and physical performance in real time, anywhere

Most wearables track either movement or physiology. Emteq does both, and adds facial muscle sensing to capture the why behind every action. It measures attention, posture, gait, sitting and standing patterns, fatigue, distraction, and emotional response, in the same moment and in the real world. Researchers, coaches, and product teams get a high-resolution stream of data that connects behavior to intent, uncovering patterns lab studies miss. Understand how people move and how they feel, without relying on recall surveys.

Facial tracking and human computer interaction for high-fidelity avatars

OCOsense enables facial muscle signals to drive avatars and telepresence in real time--a core tech for future AR eyewear. Unlike solutions by Apple and Meta, Emteq’s technology requires no bulky head-mounted cameras, no constant video streaming, no lighting limitations, and no heavy battery. By capturing expressions at the source, we cut power draw by up to 80%, slash processing overhead, and deliver continuous performance from lightweight, discreet glasses.

Proven in Clinical Research.

Published in Top Journals.

Emteq’s smart glasses have been studied by researchers and published in leading journals. These studies show the glasses can track emotions, eating habits, and physical activity without using cameras or touching the skin. Here's what the research found:

Frontiers in Psychiatry

A clinical study showed the glasses can detect how people respond emotionally, like smiling during happy moments or frowning during sad ones. People with depression showed fewer facial reactions, helping researchers spot signs of emotional blunting.

JMIR mHealth and uHealth

Researchers tested whether the glasses could detect chewing and meal patterns without relying on self-reports. Our tech identified when someone was eating with over 90% accuracy, offering a new way to study eating behaviors linked to weight gain and chronic illness.

IEEE Access

This study found that the glasses could identify facial expressions like smiling or frowning and daily movements like walking or sitting. Using safe, contact-free sensors and AI, they correctly recognized behaviors over 80% of the time.

Our Innovations Are Recognized by:

The First Tech to Measure All-Day Facial Expressions—And Change Behavior

Our patented sensor platform is the first to turn smart glasses into behavior-sensing devices by capturing thousands of subtle facial muscle movements in real time. This unlocks applications in health and wellbeing, medical research, consumer sentiment, and XR.

35

Patents (27 granted)

36

Peer-reviewed publications confirming sensor accuracy and expression analysis, used by neuroscience researchers to study facial responses and emotions in real-world settings.

Collaboration with top universities like Stanford, Northeastern, and Cambridge

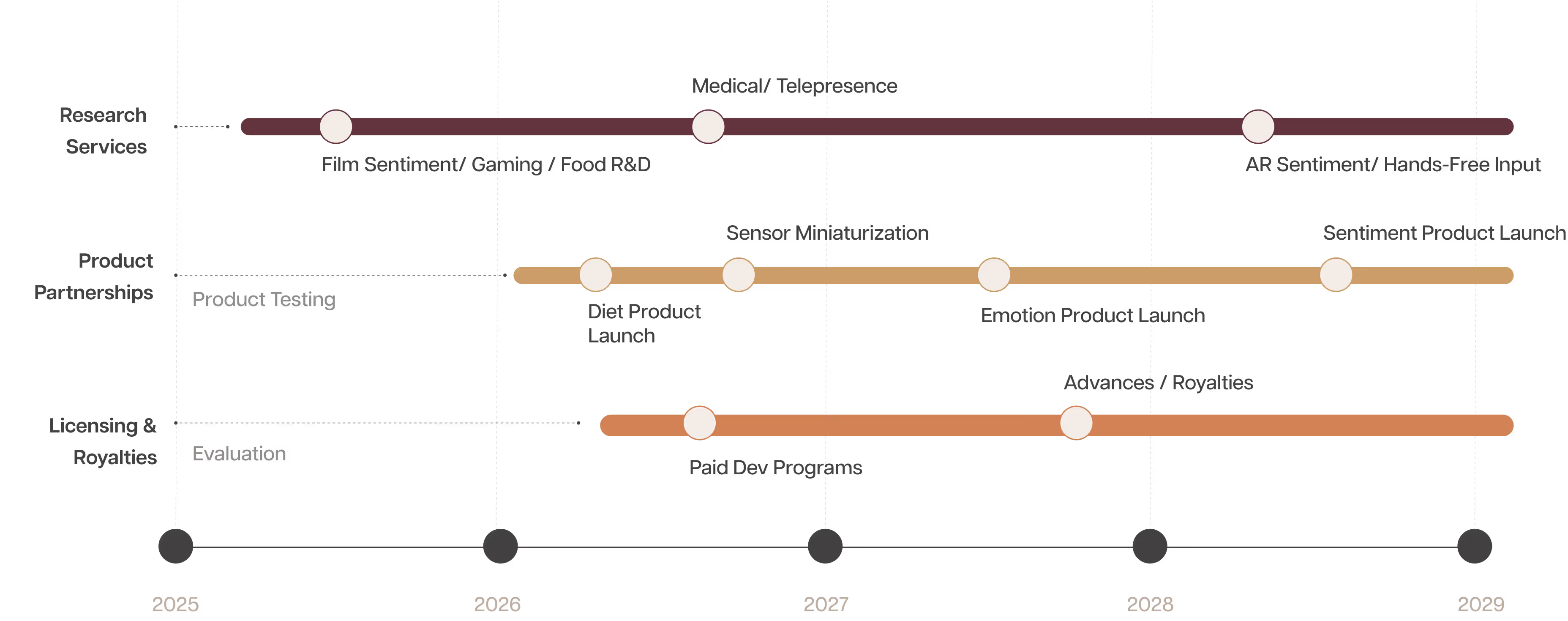

3 Revenue Streams:

Research. Products. Licensing.

Emteq generates revenue through a three-tier model designed for long-term growth. We advance our core technology through paid research services. We validate in market by launching targeted consumer products. And we scale by licensing our technology. We’re already seeing traction in each category.

Research & Services

Products

Licensing

The Road to Category Leadership in Wearable Health

Built to lead in Health, Wearables, and XR. With the funds from this raise, we will pursue critical milestones in our three revenue categories.

The First Wearable That Measures How You Eat and Automatically Logs Food

Our first consumer product–Sense Eyewear–targets diet because it’s a huge problem, our tech fits into lightweight eyewear, and the $274B market is wide open. Poor diet is the world’s top health risk, but current wearables can't reliably collect the most basic data: what we eat and how we eat it.

28

Tracks 28 diet metrics like chewing speed and distracted eating through 2.8M data points

91%

of users slowed eating, which is linked to better weight and gut health

12x

Logs meals 12x easier than phones

Only Emteq technology can measure the 4 critical daily diet inputs1 | Emotions2 | Behaviour | Activity | Diet |

|---|---|---|---|---|

| Emteq | ||||

| Smartphone | Indirect data or surveys | Indirect data or surveys | Manually logged | |

| Watch | ||||

| Ring | ||||

| CGM | Lagging indicator |

- Other factors influencing diet and weight don’t vary across the day, such as metabolism, sleep, age, genetics, and medical conditions.

- Watches, rings, and phones use indirect measures to try to measure stress and other emotions (HR, HRV, sweat response, phone activity, voice, surveys, etc.).

The First Wearable That Tracks How You Feel

1 in 5 people live with a mental health disorder, but we still rely on occasional check-ins and self-reported surveys.

Our smart glasses will change that:

Passively track emotional responses throughout the day

Automatically tag mood to people, places, and activities

Spot patterns in what improves—or worsens— mental states

How Breakthrough Innovations Power Big Tech

Many of today’s breakthrough technologies began with startups like ours. When major tech companies need new capabilities such as facial data, emotion tracking, or input interfaces, they first look to acquire the innovators who have already built them versus taking the longer path of developing the solutions in-house.

Lesser-known companies are often acquired for a specific technology or function that larger companies want to incorporate into their product.

Select AR Acquisitions

Deep Expertise in Eyewear, Emotion, and AI/ML

Our leadership brings together deep technical expertise and real-world product experience – from academic research labs to consumer hardware giants.

Former head of SnapLab, Snap Inc.'s augmented reality eyewear division and Snap's hardware-related investments and acquisitions. Previously founded and built consumer product startups including ICON Aircraft. MSME (Product Design), Stanford. AB Economics, Harvard.

Surgeon and leading authority on the face. Multi-award winning researcher, author of over 100 scientific papers and over 30 patents. Founded Emteq Labs to improve the delivery of personalized remote therapy using objective sensor data. MA, Oxford. MBBS, University of London. MD Imperial College.

Professor, scientist and Al researcher, focused on application of Al algorithms to build intelligent systems and applications. Selected as top 2% scientist worldwide for last year, Best Young Scientist in Macedonia for 2017, and award winner of ML competitions. Author of >100 papers on human behavior and emotion Al.